Hardware Wallets: Are They Worth the Investment?

Understanding Hardware Wallets: An Introduction to Secure Crypto Storage

Understanding Hardware Wallets: An Introduction to Secure Crypto Storage

When it comes to ensuring the safety and security of your hard-earned cryptocurrency, hardware wallets play a pivotal role. In this blog post, we will delve into the various aspects of hardware wallets—what they are, why they are important, and how they provide a secure avenue for crypto storage.

A hardware wallet is a physical device designed to store and safeguard your cryptocurrencies. Unlike software wallets or online exchanges, which are more susceptible to hacking attempts or malicious attacks, hardware wallets offer an offline means of storage. By ensuring that your private keys and sensitive data remain offline, these devices significantly reduce the risks associated with online storage systems.

One of the fundamental features of a hardware wallet is its ability to generate and store private keys securely within the device itself. Instead of relying on an internet connection or software to generate keys, hardware wallets use Random Number Generators (RNGs) to create these keys in an isolated environment referred to as the “secure element.” This isolation helps prevent any potential leakage of private keys, making hardware wallets highly resistant to cyber threats and hacking attempts.

Moreover, hardware wallets incorporate two-factor authentication—the first layer being physical possession of the device and the second layer being entering a PIN code to initiate any transaction. The combination of these security measures ensures that only the rightful owner can access and authorize transactions on their hardware wallet.

One crucial advantage offered by some hardware wallets is support for multiple cryptocurrencies. Depending on the model and manufacturer, these devices can accommodate various cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many more. This versatility allows users to manage different types of assets using a single hardware wallet.

Setting up a hardware wallet is typically straightforward. Users need to initiate a guided setup process where they are provided with instructions to configure their device, set PIN codes, and create recovery phrases. This recovery phrase acts as a backup in case the device is lost, stolen, or damaged. These phrases consist of a series of words that can be used to restore access to your cryptocurrency funds.

Furthermore, hardware wallets also enable users to connect and interact with software interfaces known as wallet applications. These applications allow users to view their crypto balances, send or receive funds, and even access additional features specific to each coin or token. However, the core advantage remains that the private keys and transactions are securely confirmed by the hardware wallet itself.

In conclusion, understanding hardware wallets is crucial for securely storing cryptocurrencies. These devices offer an offline and isolated means of storage, safeguarding your digital assets from potential hacking attempts. Incorporating robust security measures such as RNGs and two-factor authentication ensures that only the rightful owner has control over their funds. With support for multiple cryptocurrencies and straightforward setup procedures accompanied by recovery phrases, hardware wallets provide a versatile and user-friendly option for anyone eager to maximize the security of their crypto holdings.

The Evolution of Hardware Wallets: How They’ve Shaped Crypto Security

Hardware wallets have revolutionized the world of cryptocurrency security by providing a physical device that stores private keys and secures valuable digital assets. This evolution has been crucial, considering the rise of various cyber threats and hacking attempts targeting the crypto market.

Initially, software wallets were the primary choice for storing cryptocurrencies. These wallets were essentially applications or online platforms that allowed users to manage their digital assets online. However, they presented a certain level of vulnerability since hackers could potentially access wallet files or manipulate transactions through malware or phishing attacks.

The need for enhanced security led to the development of hardware wallets. The first hardware wallet emerged in 2011 to address the shortcomings of software wallets. These compact devices, resembling USB drives or smart cards, were uniquely designed to securely store private keys and perform cryptocurrency transactions offline.

Hardware wallets introduced a two-factor authentication method that significantly reduced risks associated with online attacks. This authentication process required users to physically connect the hardware wallet to a computer or mobile device and authenticate transactions using cryptographic algorithms.

Furthermore, hardware wallets adopted different innovative measures to ensure security. They implemented PIN code protection for accessing the device, preventing unauthorized individuals from gaining access even if they physically possess the wallet. Some newer hardware wallets also include a built-in screen that displays transaction details before approving them, reducing the risk of potential phishing attacks.

As the demand for hardware wallets grew, manufacturers improved their products’ functionality and compatibility with various cryptocurrencies. Today, there are numerous hardware wallet options available, supporting a wide range of digital currencies.

One significant advantage of hardware wallets is their offline accessibility. Because these devices store private keys offline and only connect to an internet-connected device when initiating transactions, they effectively protect cryptocurrencies from being exposed to potential online threats. Physical theft or unauthorized access is also mitigated through the combination of PIN code protection and self-destruction mechanisms (encrypted storage erasure) triggered after repeated failed login attempts.

Hardware wallets have undoubtedly shaped crypto security by providing an uncomplicated yet powerful solution for individual users and institutional investors alike. They have proven to be an efficient safeguard against phishing attacks, malware infections, and the compromise of private keys.

The evolution of hardware wallets is an ongoing process aiming to make them even more secure and user-friendly. Manufacturers continually update their firmware to patch vulnerabilities, offer new features, and ensure compatibility with emerging cryptocurrencies.

In conclusion, hardware wallets have played a critical role in enhancing the security measures surrounding cryptocurrency transactions. Their innovation, offline storage mechanisms, two-factor authentication, and other advanced security features have significantly reduced the chances of asset theft and hacking incidents. As the cryptocurrency market continues to expand, it is expected that hardware wallets will continue to evolve, adapting to new challenges and providing users with reliable ways to protect their digital assets.

Comparing Hardware and Software Wallets: Which is Right for Your Crypto?

When it comes to choosing a wallet for storing your cryptocurrency, there are two main options available: hardware wallets and software wallets. Both have their strengths and weaknesses, so finding the right one for you depends on your specific needs and preferences.

Hardware wallets, as the name suggests, are physical devices that store your cryptocurrency offline. They are often small, portable gadgets that you can connect to your computer or mobile device via USB or Bluetooth. One of the biggest advantages of hardware wallets is their superior security. Since your private keys and sensitive information never leave the device, they are much less vulnerable to hacking attempts or malware attacks compared to software wallets.

Another advantage of hardware wallets is their ability to provide an extra layer of protection against phishing scams. Hardware wallets typically require physical connection confirmation before authorizing any transactions, making it difficult for attackers to convince users to hand over their credentials unknowingly.

However, despite these security benefits, hardware wallets do have a few drawbacks. Firstly, they come with a cost – you need to purchase the physical device upfront. Additionally, hardware wallets can sometimes be more complex to set up and use than software wallets, requiring a learning curve for those new to cryptocurrency.

On the other hand, software wallets refer to applications or online platforms that enable users to store their cryptocurrency on various devices such as computers and smartphones. Software wallets offer convenience since you can access them from anywhere with an internet connection. Many popular cryptocurrencies have their own dedicated software wallets developed by trusted providers.

In terms of cost-effectiveness, software wallets usually have an advantage over hardware wallets as they don’t require purchasing any extra physical equipment. They often offer user-friendly interfaces that make managing multiple cryptocurrencies straightforward.

However, because software wallets store your private keys digitally, they are potentially more susceptible to hacking attempts or malware infections if proper precautions are not taken. It’s crucial to choose reputable software wallet providers who prioritize security and frequently update their platforms.

Ultimately, choosing between hardware and software wallets comes down to prioritizing security versus convenience. If you plan to store significant amounts of cryptocurrency or prioritize top-level security, a hardware wallet may be the best choice for you. On the other hand, if you’re managing smaller amounts and prioritize ease of use, a software wallet might suffice.

It’s also worth considering a hybrid approach that combines the benefits of both options. For instance, you could keep the majority of your cryptocurrency in a hardware wallet for long-term storage and additionally utilize a software wallet for everyday transactions.

In conclusion, selecting the ideal wallet for your crypto assets necessitates striking a balance between maintaining tight security and enjoying convenience. Assess your requirements, evaluate the pros and cons of each type, and make an informed decision while keeping your holdings safe in the volatile world of crypto markets.

Behind the Scenes: How Hardware Wallets Keep Your Cryptocurrency Safe

Hardware wallets play a significant role in securing and safeguarding cryptocurrency holdings. When it comes to storing cryptocurrencies like Bitcoin or Ethereum, the importance of keeping them secure cannot be overstated. While software wallets provide a convenient way to access and manage digital assets, hardware wallets offer an additional layer of security that effectively protects against various cyber threats.

So, what goes on behind the scenes to ensure these hardware wallets keep your cryptocurrency safe?

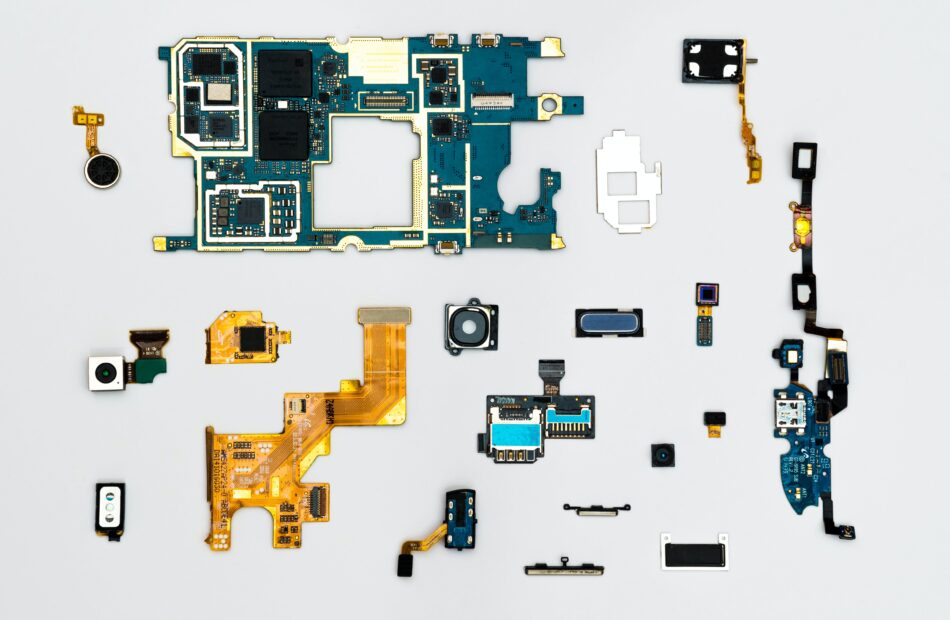

First and foremost, hardware wallets are designed with specialized security features that distinguish them from other types of wallets. These devices are physical in nature and resemble USB flash drives or small gadgets with secure screens for accessing and confirming transactions. They are usually equipped with a secure element (SE), which is a tamper-resistant chip specifically built for security purposes.

At their core, hardware wallets generate and store private keys offline. A private key is essentially a digital signature used to authenticate transactions made on the blockchain network. By generating private keys on a secure device, hardware wallets ensure that these keys never touch an internet-connected device where they could be potentially compromised by hackers or malware.

To provide added protection, hardware wallets typically require users to set up a unique PIN code during the initial setup process. This PIN code acts as the first line of defense against unauthorized access to the wallet. Upon multiple failed attempts to enter the PIN code correctly, most hardware wallets have built-in mechanisms that initiate data-wiping processes, further safeguarding against brute-force attacks.

When making transactions, the hardware wallet employs its screen capabilities to display all important transaction details. This ensures that users can review every detail before confirming the transaction physically on the device itself. The purpose of this visual verification step is to mitigate any attempts at executing unauthorized or manipulated transactions. Additionally, some advanced hardware wallets further have buttons for user interaction, adding an extra layer of confirmation during important processes.

Furthermore, hardware wallets offer convenient backup and recovery procedures. During the setup process, users are generally advised to create a unique set of recovery seed words or phrases. These seed words act as another layer of access to recover the wallet contents if the device is lost, stolen, or damaged. Storing these seed phrases securely in a separate physical location prevents unauthorized access and prevents loss of funds even if the hardware wallet itself is compromised.

To ensure ongoing protection, hardware wallet manufacturers periodically release firmware updates that address possible vulnerabilities or enhance the overall security posture of the device. It is crucial for users to stay up-to-date with these firmware updates and promptly apply them to their hardware wallets.

It’s important to highlight that while hardware wallets significantly mitigate the risk of online attacks and malicious activities, no security solution is completely infallible. Users must remain cautious in their interactions with the hardware wallet, practice safe digital hygiene such as connecting only to trusted devices, and implementing appropriate security measures on the devices they use to access their wallets.

In summary, hardware wallets serve as physical vaults for cryptocurrencies, employing a combination of specialized security features to keep them safe. Offline private key generation, PIN code protection, visual transaction verification, backup and recovery options, as well as firmware updates represent some of the behind-the-scenes safeguards implemented by hardware wallets to protect your valued digital assets effectively.

A Closer Look at Top Hardware Wallet Brands and Their Features

A Closer Look at Top Hardware Wallet Brands and Their Features

When it comes to securing your cryptocurrency holdings, hardware wallets have become increasingly popular among crypto enthusiasts. Hardware wallets are physical devices designed to store private keys offline, ensuring that your digital assets remain safe from online threats such as hacking or malware.

Several top hardware wallet brands have emerged in the market, each offering unique features and benefits. Let’s take a closer look at some of these brands:

Trezor: Trezor is one of the leading names in the hardware wallet industry. It offers a wide range of features, including a user-friendly interface, support for multiple cryptocurrencies, and compatibility with popular operating systems like Windows, macOS, and Linux. Trezor’s emphasis on security is evident with its PIN protection, passphrase encryption, and two-factor authentication options.

Ledger: Another prominent player in the hardware wallet market is Ledger. It offers a range of devices catering to different user requirements. Ledger supports over 1,500 cryptocurrencies and provides an intuitive interface for managing assets. The wallets feature secure chips isolating transactions and sensitive data, further strengthening the overall security of stored funds.

KeepKey: KeepKey is known for its sleek design and simplicity. It supports around 50 major cryptocurrencies and integrates with popular wallets like Electrum and MyEtherWallet. KeepKey ensures secure private key generation using its offline environment. The device includes a built-in OLED display, allowing users to verify transactions visually.

BitBox: Developed by Shift Crypto Security AG, BitBox aims to provide secure hardware wallet options for both beginners and experienced users. It focuses on an open-source approach and emphasizes ease of use. BitBox features multiple layers of security mechanisms like touch sensors, encrypted microSD for backups, and a secure chip for preventing physical attacks.

SecuX: SecuX is relatively new to the hardware wallet scene but has gained attention quickly. It offers an array of features encompassing wallet management, crypto exchanges, and a mobile app for convenience. Besides multi-currency support, SecuX incorporates a robust security framework with an embedded chip and cryptographic firmware verification.

Conclusion: The market for hardware wallets continues to expand alongside the rising adoption of cryptocurrencies. Brands like Trezor, Ledger, KeepKey, BitBox, and SecuX have established their positions among the top contenders. Consider your requirements and preferences when choosing a hardware wallet as they vary in terms of supported currencies, user interface, ease of use, design, and additional security features. Ultimately, opting for a trusted and well-respected brand will ensure the safety of your digital assets.

Protecting Your Investment: Benefits of Using a Hardware Wallet for Long-term HODLing

Protecting Your Investment: Benefits of Using a Hardware Wallet for Long-term HODLing

Cryptocurrencies have gained significant traction in recent years, and as the market grows, so do the concerns around the security of one’s crypto investments. While digital wallets and exchanges strive to enhance security measures, hackers continue to pose a threat. One effective solution for long-term ‘HODLing’ (holding onto your crypto assets) is to use a hardware wallet. Here are some essential benefits of opting for a hardware wallet to protect your investment:

- Enhanced Security: One of the primary advantages of using a hardware wallet is its superior security compared to other alternatives like software wallets or keeping your crypto on an exchange. Hardware wallets store your private keys offline and require physical access, minimizing the risk of online hacks or potential software vulnerabilities.

- Cold Storage: A hardware wallet operates as cold storage because it remains disconnected from the internet when not in use. This isolation greatly reduces the chances of unauthorized access or cyberattacks attempting to compromise your funds since hackers cannot reach a device that is not connected to the online world.

- Secure Chip Technology: Most reliable hardware wallets come equipped with secure chip technology, providing an additional layer of protection against attacks. These chips effectively safeguard your private keys and ensure transaction integrity by encrypting sensitive data.

- Protection against Advanced Threats: Hardware wallets offer protection against advanced threats such as keyloggers or viruses lurking on your computer that can compromise software wallets or exchanges. Since transactions are processed within the secure device itself, malicious software on your computer cannot intercept or manipulate them.

- Simplified Backup and Recovery: Hardware wallets typically generate seed phrases during the initialization process. These phrases act as backups of your private keys and device settings. In case of loss, damage, or theft, you can easily recover your entire wallet using this seed phrase without losing access to your funds.

- Cross-platform Compatibility: Hardware wallets are often compatible with multiple operating systems and can connect seamlessly with various cryptocurrency wallets. Whether you use a Windows, macOS, or Linux computer, or even prefer your smartphone for managing your investments, hardware wallets offer the flexibility to secure your assets accordingly.

- Peace of Mind: By utilizing a hardware wallet, you gain peace of mind regarding the security of your investments. Knowing that your crypto holdings are stored in an offline device with robust security features significantly reduces the fear of losing funds due to external breaches.

In conclusion, protecting your investment is crucial when participating in the crypto market. Hardware wallets provide higher security levels by isolating private keys from potential online threats and reducing the risks associated with software wallets and exchanges. With enhanced security measures and easy backup options, using a hardware wallet offers peace of mind for long-term HODLing strategies and encourages responsible crypto asset management in an ever-evolving digital world.

Case Studies: Real-life Experiences with Hardware Wallets and Asset Security

In the world of cryptocurrency, where securing digital assets is of paramount importance, hardware wallets have emerged as a popular choice for safeguarding one’s investments. These devices are designed to store users’ private keys offline, ensuring enhanced security against hacks and unauthorized access.

Case studies, showcasing real-life experiences with hardware wallets, provide valuable insights into their usability, effectiveness, and overall asset security. Through these stories, investors can gain a deeper understanding of the benefits and potential risks associated with different hardware wallet models.

One such case study features John, an avid crypto enthusiast who decided to secure his substantial digital holdings with a hardware wallet. Before making his purchase, John extensively researched various options available in the market. After careful analysis, he settled on a top-rated hardware wallet that offered robust security features and compatibility with multiple cryptocurrencies.

To test its efficiency, John conducted numerous trials that involved sending and receiving a variety of cryptocurrencies. With each successful transaction, he increasingly grew confident in the reliability of his hardware wallet’s encryption methods and cryptographic algorithms. The seamless experience eased any initial anxieties he had about the storage solution.

Another case study explored the experience of Mary, a small business owner who had recently started accepting cryptocurrencies as payment from her clients. Mary opted for a different hardware wallet due to its distinctive features tailored toward business usage. This model included additional functionalities such as multi-signature authentication and secure QR code generation for seamless payment processing.

Through her case study, Mary highlighted the practicality of using hardware wallets to handle business transactions securely. She emphasized the ease of integration with existing payment systems and underscored the peace of mind it brought both to her and her clients.

In another real-life scenario, Jason, a freelancer who primarily earned income through various cryptocurrency projects, shared how he deeply regretted not securing his assets earlier on in his career. He recounted an unfortunate incident where he fell victim to a phishing attack that compromised his online account’s login credentials. This incident led to the loss of a significant portion of his financial reserves.

Learning from this costly mistake, Jason immediately adopted a hardware wallet to shield his newly acquired digital assets. He praised the additional layer of security it provided, as it ensured that even if his computer was compromised in the future, his funds would remain safe within the isolated hardware device.

These case studies serve as valuable examples of real experiences with hardware wallets and highlight their effectiveness in protecting cryptocurrency holdings. From individual investors to businesses and freelancers, the adoption of hardware wallets offers crucial safeguarding measures against potential threats lurking in the ever-evolving crypto market.

Understanding the experiences shared by these real users is essential for individuals looking to secure their own digital assets. These insights can guide them in selecting the right hardware wallet that aligns with their specific requirements and risk appetites.

As the crypto landscape evolves and new advancements in asset security emerge, it remains crucial for enthusiasts and investors alike to continue sharing these real-life case studies. Ultimately, by building an extensive knowledge base focused on hardware wallet exhibitions and asset security experiences, both newcomers and veterans in the crypto space can navigate the market more confidently while ensuring their investments remain protected.

Losing Access to Your Crypto Assets: Mitigating Risks with Hardware Wallets

Losing access to your crypto assets can be a nightmare for any investor. Whether it’s through hacking attempts, device theft, or losing passwords, the consequences can be dire. Fortunately, there are ways to mitigate these risks, and one popular solution is hardware wallets.

Hardware wallets are physical devices specially designed to secure cryptocurrencies. Unlike software wallets that are “hot” and connected to the internet, hardware wallets are “cold” and not vulnerable to online threats. They offer strong protection against unauthorized access and keep your assets safe even if your computer or smartphone is compromised.

One of the key advantages of hardware wallets is their ability to store private keys offline. Private keys are essential for signing transactions and accessing your crypto funds. By keeping these keys off the internet, hardware wallets significantly reduce the risk of key theft by hackers or malware.

Hardware wallets also employ different layers of security to enhance asset protection. Most models have a built-in screen and buttons that enable you to confirm transactions directly on the device. This ensures that even if your computer is infected with malware, attackers cannot modify transaction details without your consent.

Additionally, some hardware wallets incorporate additional security measures like passphrase protection. With this feature, you can add an extra layer of encryption by setting up a unique passphrase known only to you. Even if someone gains physical access to your hardware wallet, they would still need this passphrase to unlock and access the assets inside.

Moreover, these portable devices usually provide backup options in case of loss or damage. They often generate a recovery seed—a mnemonic phrase consisting of multiple words—that allows you to recover your crypto holdings if your hardware wallet is ever misplaced or malfunctions. This seed should be diligently stored in a safe place because anyone with access can potentially gain control over your assets.

Although hardware wallets provide robust security measures, it’s important to stay updated on potential vulnerabilities or firmware updates associated with your specific device. Manufacturers regularly release firmware upgrades addressing certain weaknesses or introducing new security features. By keeping your hardware wallet firmware up to date, you can ensure you have the latest protections against emerging risks.

In conclusion, losing access to your crypto assets is a major concern that can have severe financial consequences. To safeguard your investments, considering a hardware wallet is a smart move. With their offline storage, private key protection, transaction confirmation screens, passphrase encryption, and recovery seed backup, hardware wallets provide a solid defense against potential threats in the ever-evolving crypto market.

Understanding the Cost: Analyzing the Investment in a Quality Hardware Wallet

Understanding the Cost: Analyzing the Investment in a Quality Hardware Wallet

As the popularity of cryptocurrencies surges, ensuring the security of your digital assets becomes paramount. One essential tool for safeguarding your crypto investments is a hardware wallet. A hardware wallet is a physical device that securely stores your private keys offline, away from hackers and malicious software.

However, obtaining a high-quality hardware wallet involves an upfront investment. It’s crucial to thoroughly analyze the cost and benefits before making a decision. Here are some key points to consider:

Security: The first aspect to assess is the level of security provided by the hardware wallet. These devices employ advanced encryption techniques and offer various security features to protect your funds. While their prices may vary, it’s vital to prioritize quality over cost when it comes to securing your assets.

Reliability: Reliability is another factor influencing the cost of a hardware wallet. Premium devices are built with robust materials and undergo rigorous testing to ensure their durability and longevity. This reliability ensures that your hardware wallet remains functional and safeguards your investments over an extended period, minimizing the risk of losing access to your funds.

Usability: Investing in a hardware wallet that offers user-friendly interfaces and easy navigation can save you plenty of headaches down the road. Although some wallets may cost more due to enhanced usability features, such as touch screens or large display sizes, consider how important these aspects are for you in terms of convenience and ease of operation.

Compatibility: Different hardware wallets support distinct cryptocurrencies, so verifying compatibility is vital. Ensure that the wallet you choose supports the specific cryptocurrencies you hold or plan to invest in. While certain budget options may not support as many coins as more expensive counterparts, understanding your investment portfolio will help you choose accordingly.

Extra Features: Comparing hardware wallets based on additional features they offer is crucial for making an informed decision. Check for features like Bluetooth connectivity, backup options, multisignature support, or companion applications that enhance the device’s functionality. Analyze whether these added features are justified by an increased price and if they align with your investment strategy or requirements.

Customer Support: Investing in a reputable hardware wallet often means benefitting from superior customer support. Prompt assistance during any technical difficulties or concerns enhances the overall user experience and can help in alleviating potential issues swiftly. Consider reading reviews, checking forums, and evaluating the responsiveness of customer support before making a purchase.

Ultimately, understanding the cost behind a quality hardware wallet involves assessing various factors such as security, reliability, usability, compatibility, extra features, and customer support. It’s important to choose a device that aligns with your investment needs and provides peace of mind when it comes to safeguarding your valuable cryptocurrencies. Remember, a minor investment in securing your assets today can potentially save you from significant losses in the future.

Advanced Security Features of Modern Hardware Wallets: From Biometrics to Multi-Sig

Ensuring the security of one’s cryptocurrency assets has always been crucial, especially with the relentless rise of digital threats. With this in mind, modern hardware wallets have emerged, offering advanced security features that provide users with peace of mind and protection against potential hacking attempts. Let’s delve into some of these noteworthy security measures employed by modern hardware wallets.

- Biometrics: In a bid to enhance security, some modern hardware wallets incorporate biometric authentication methods such as fingerprint scanning or facial recognition. By employing biometrics, users can ensure that their private keys remain accessible only to them, preventing unauthorized access to their crypto holdings.

- Secure Element: Modern hardware wallets often come equipped with a specialized microcontroller called a secure element (SE). This secure element acts as a fortified vault within the device specifically designed to securely store private keys and render them tamper-resistant. The use of a secure element adds an extra layer of protection against physical attacks.

- Offline Storage: One key characteristic of hardware wallets is their ability to operate offline, also known as cold storage. This means that private keys never leave the device and transactions are signed internally, thus mitigating the risk of exposing sensitive information or performing transactions on potentially compromised devices connected to the internet.

- Passphrase Encryption: Hardware wallet users can opt for an additional layer of security through passphrase encryption. This feature allows users to encrypt their private key with a chosen passphrase, which must be entered when accessing the wallet. Passphrase encryption acts as an extra line of defense even if someone gains unauthorized physical access to the device.

- PIN Protection: To prevent unauthorized internal access to the device itself, modern hardware wallets commonly require the user to set up a unique Personal Identification Number (PIN) upon initialization. The PIN acts as a barrier, ensuring that only authorized individuals can unlock and access the wallet’s functionalities.

- Multi-signature Support: Many modern hardware wallets support multi-signature (multi-sig) transactions. Multi-sig requires multiple signatures from different parties to authorize a transaction, effectively minimizing the risk of a single point of failure. This feature enhances security and is particularly useful for shared accounts or organizations, where multiple approvals may be required before executing transactions.

- Hidden Wallets: To protect against coercive measures or potential theft, certain modern hardware wallets include hidden wallet functionalities. These hidden wallets are essentially decoy or secondary wallets users can access using separate PINs or passphrases. With a specific PIN or passphrase, users can access a separate wallet that contains less valuable funds, ensuring plausible deniability and safeguarding their primary holdings.

- Open-Source Auditing: Several modern hardware wallet manufacturers make efforts to enhance transparency and security by making their devices’ firmware or software open-source. This means that independent developers can review the code for vulnerabilities, enhancing the overall security aspects of the hardware wallet.

In conclusion, modern hardware wallets leverage various advanced security features to provide users with heightened protection for their cryptocurrency assets. From biometrics and secure elements to offline storage and multi-signature support, these advancements bolster confidence in crypto storage by minimizing the risks associated with cyberattacks and unauthorized access.

The Future of Hardware Wallets: Emerging Technologies and Trends in Crypto Security

The Future of Hardware Wallets: Emerging Technologies and Trends in Crypto Security

In recent years, the cryptocurrency market has witnessed significant growth, attracting a vast number of investors and enabling various technological advancements. With this progression, ensuring the security of digital assets has become a top priority for users. To address this concern, hardware wallets have emerged as one of the most secure ways to store cryptocurrencies.

A hardware wallet is a physical device that securely stores cryptographic keys used to access cryptocurrencies. Unlike software wallets, which are vulnerable to online threats such as malware or phishing attacks, hardware wallets provide an extra layer of security by keeping private keys offline. With the rising popularity of these devices, it is crucial to explore the emerging technologies and trends shaping the future of hardware wallets.

At present, hardware wallets primarily utilize USB connections to interact with computing devices. However, wireless connectivity is an emerging trend that offers enhanced user convenience. Bluetooth-enabled hardware wallets allow users to connect securely to their smartphones or tablets. This advancement improves accessibility without compromising the critical separation between private keys and potential online threats.

Another emerging technology poised to impact hardware wallet development is Near Field Communication (NFC). NFC enables contactless communication between smartphones or other devices in close proximity. This innovation could soon allow users to complete secure transactions by simply tapping their hardware wallet against a compatible smartphone or point-of-sale terminal.

The integration of biometric authentication into hardware wallets is also gaining traction as a means to enhance security. Biometrics, such as fingerprint sensors or facial recognition capabilities, add an additional layer of protection against unauthorized access to private keys. These advanced security features provide users with increased peace of mind in case their physical device falls into the wrong hands.

As the crypto market continues to expand, interoperability among different cryptocurrencies becomes essential. Cross-compatibility between various blockchain networks is already gaining significance, and future hardware wallet designs will likely cater to multi-blockchain support seamlessly. This development would enable users to store a variety of cryptocurrencies on a single hardware wallet, streamlining the overall user experience.

Moreover, the scarcity of physical storage can be a potential threat to hardware wallets. However, emerging technologies including advancements in microSD card storage or cloud-based backups aim to solve this issue. By expanding storage capacity or syncing devices with secure cloud storage servers, users can ensure convenient management of their digital assets without sacrificing security.

Furthermore, as blockchain technology evolves, decentralized finance (DeFi) projects are gaining popularity. These projects extend financial services on the blockchain, such as lending or borrowing, but may require integration with hardware wallets for seamless user experience. Anticipating this demand, future hardware wallet designs are likely to include enhanced interoperability with DeFi platforms.

In summary, the future of hardware wallets in the crypto market points toward a confluence of emerging technologies and evolving trends aimed at improving both convenience and security. The integration of wireless connectivity, biometrics, NFC, and increased compatibility among different cryptocurrencies will result in hardware wallets that offer paramount protection for users’ digital assets. As the crypto industry continues to progress rapidly, the evolution of hardware wallets promises to meet the growing consumer needs for effective crypto security.

Making the Switch to a Hardware Wallet: Steps for a Smooth Transition

Making the switch to a hardware wallet is an essential step to ensure the security of your cryptocurrency holdings. Moving your digital assets from a software wallet or exchange to a hardware wallet offers increased protection against potential risks such as online attacks and fraud attempts. Here are some steps to help you make a smooth transition to a hardware wallet:

- Research and choose the right hardware wallet: Start by exploring different hardware wallet options available in the market. Conduct thorough research, read reviews, compare features, and check for compatibility with your desired cryptocurrencies. Popular hardware wallets include Ledger, Trezor, and KeepKey.

- Purchase a legitimate device: To avoid falling victim to scams or counterfeit products, only buy your hardware wallet directly from the manufacturer or authorized resellers. Be cautious of any tempting deals that seem too good to be true, as they may lead to compromised security.

- Ensure device authenticity and security seals: Before setting up your hardware wallet, always double-check for authenticity seals on the packaging or device itself. Confirm that the product has not been tampered with during shipping or handling to guarantee its security.

- Familiarize yourself with the user interface: Once you have unboxed your new hardware wallet, spend time getting acquainted with its interface. Understand how it works, its buttons, screen functionality, and menu navigation to ensure you can easily manage your digital assets.

- Install necessary software/applications: To set up your hardware wallet, you’ll likely need to install desktop or mobile applications provided by the manufacturer. Visit their official website and download the supported software specifically designed for your device model.

- Create a new wallet or import existing one: Depending on your situation, you can either create a new wallet on your hardware device or transfer an existing one from a software wallet. In case of the latter, ensure you have followed all backup procedures before proceeding with the transfer.

- Safely store recovery seed phrases: During the initial setup, you will receive a recovery seed phrase consisting of a series of words. These are crucial for accessing your funds in case your hardware wallet is lost, stolen, or damaged. Write down this phrase on durable offline media and store it in a safe location.

- Transfer your cryptocurrencies: To complete the transition, initiate transfers from your software wallet or exchange account to the newly set up hardware wallet. Follow specific instructions provided by the hardware wallet manufacturer for each supported cryptocurrency to ensure successful transfers.

- Triple-check addresses and confirmations: When transferring funds, pay close attention to the recipient addresses on both the software and hardware wallets. Double- or triple-check to avoid any errors that could result in loss of funds. Ensure all transactions are accurately confirmed on both ends before disconnecting your hardware device.

- Securely backup your new hardware wallet: Regularly create backups of your hardware wallet using tools recommended by the manufacturer. Perform backups both online (encrypted cloud storage) and offline (external hard drives, USB sticks) to minimize vulnerability to potential loss or damage.

Making the switch to a hardware wallet enhances the protection of your cryptocurrency investments significantly. Remember to invest time in understanding your chosen device and following security best practices throughout the transition process.

Hardware Wallet Compatibility: Ensuring Support for Your Favorite Cryptocurrencies

Hardware Wallet Compatibility: Ensuring Support for Your Favorite Cryptocurrencies

When it comes to safeguarding your precious cryptocurrencies, hardware wallets serve as a reliable and secure option. These physical devices store your digital assets offline, keeping them safe from potential hacks or online vulnerabilities posed by software wallets or exchanges. However, it is vital to ensure that your chosen hardware wallet is compatible with the cryptocurrencies you wish to store.

First, it is crucial to understand that not all hardware wallets offer support for every cryptocurrency available in the market. While some wallets might have broad compatibility, others may be limited to supporting only a select few. Therefore, before investing in a hardware wallet, it’s key to consider the specific cryptocurrencies you own or plan to acquire and whether your wallet of choice aligns with those digital assets.

One aspect of ensuring compatibility is verifying if the hardware wallet supports the blockchain technology on which your favorite cryptocurrencies are built. Different digital currencies utilize various underlying technologies, such as Bitcoin’s blockchain or Ethereum’s smart contract platform. Consequently, not all wallets may accommodate both Bitcoin and Ethereum or other altcoins simultaneously.

In addition to blockchain technology compatibility, also consider whether the hardware wallet manufacturer provides dedicated support for specific cryptocurrencies. As the crypto market expands rapidly, new cryptocurrencies emerge frequently. Hardware wallet manufacturers must update their firmware and software infrastructure accordingly to integrate newly released digital assets securely. Therefore, it’s important to stay updated on any announcements or information provided by the wallet manufacturer regarding added compatibility for new coins.

Moreover, some hardware wallets allow third-party integrations through dedicated apps or software interfaces. These integrations enable users to access additional cryptocurrency wallets while still benefiting from the hardware wallet’s security features. For instance, certain wallets may support popular multi-currency management applications like MyEtherWallet or Electrum, broadening compatibility with a wider range of cryptocurrencies.

Before making a purchase decision based solely on hardware wallet compatibility, it’s advisable to conduct thorough research and seek insights from credible sources. Official websites, user forums, and online communities focused on cryptocurrency can offer valuable information about a particular wallet’s capabilities and strengths. Unearthing expert opinions and real-life experiences can help you determine if a hardware wallet truly aligns with your specific crypto portfolio and future expansion plans.

Remember, ensuring compatibility is essential to securely managing your cryptocurrencies through a hardware wallet. By selecting a wallet that supports the blockchain technology of your preferred digital assets, accommodates new coins, and offers third-party integrations for increased compatibility, you can enhance your crypto storage experience while safeguarding your investments.

Backing Up Your Hardware Wallet: Strategies for Recovering Your Assets Post-Loss

Backing Up Your Hardware Wallet: Strategies for Recovering Your Assets Post-Loss

Losing a hardware wallet, whether it’s due to theft, damage, or simple misplacement, can be a distressing situation for any cryptocurrency investor. However, with the right strategies in place, you can minimize the risk of permanently losing access to your valuable digital assets. In this blog post, we’ll explore various techniques for backing up your hardware wallet and recovering your funds in case of loss.

Firstly, it is vital to understand the significance of backing up your hardware wallet. A hardware wallet serves as a secure storage device for your private keys, ensuring that your cryptocurrencies remain protected from online threats. Without access to the private key stored within the hardware wallet, you could find yourself unable to retrieve or manage your assets effectively.

To safeguard against potential loss scenarios, one recommended approach is creating a mnemonic seed phrase during the setup process of your hardware wallet. This seed phrase generally consists of a series of randomly generated words, often around 12 to 24 in number. Jot down these words carefully on multiple pieces of paper and store them separately in secure locations. By doing so, even if you lose your hardware wallet, you still possess the means to recover your cryptocurrencies by entering this seed phrase into a compatible device or wallet.

Another option to consider is using metal backup solutions to store your mnemonic seed phrase more securely. Brands like Billfodl and Cryptosteel offer metal plates that can be engraved with the seed phrase, helping protect against potential issues related to fire, water damage, or degradation over time. Remember to separate individual words such that they need to be assembled correctly to restore access successfully.

Furthermore, you should always keep digital copies of the seed phrase offline and password protect any files containing this sensitive information. Saving an encrypted copy using strong encryption software or services like Veracrypt helps prevent unauthorized access. Store these encrypted files on separate, password-protected USB drives or external hard drives. Distribute these backups across various secure locations to minimize the risk of total loss.

Alternatively, exploring the concept of multi-signature wallets can provide enhanced security in scenarios where one hardware wallet is lost or stolen. With a multi-signature setup, several private keys are required for transactions to be authorized. By keeping backup hardware wallets safely stored with trusted individuals, you can still access your funds even if one of these devices becomes unavailable.

Regularly testing backup and recovery procedures is crucial to ensure they work correctly when required. Practice recovering your assets using your seed phrase on a compatible software wallet or another hardware wallet. This way, you can confirm the backup procedure functions as intended and gain confidence that you will be able to access your assets again if disaster strikes.

To quickly detect hardware wallet loss, stay vigilant and monitor its physical whereabouts. Maintain a habit of double-checking its location after each usage and regularly inspecting its storage location for signs of tampering or theft. Additionally, consider utilizing smart tracking technologies like GPS or RFID tags to aid in the recovery process if your hardware wallet does go missing.

In conclusion, backing up your hardware wallet properly is essential for safeguarding your cryptocurrency investments. By leveraging mnemonic seed phrases, metal backup solutions, multi-signature wallets, and encrypted digital copies, you enhance your chances of recovering your assets even in the event of loss. Remember to test recovery procedures regularly and remain attentive to minimize the risk in the first place.

The crypto market refers to the world of cryptocurrencies, which are digital or virtual currencies that use cryptography to secure transactions and regulate new unit creation. It encompasses various aspects related to cryptocurrencies, blockchain technology, and the financial ecosystem surrounding them.

Cryptocurrencies such as Bitcoin, Ethereum, Ripple, Litecoin, and many others are decentralized digital assets that operate on a technology called blockchain. Blockchain is a distributed ledger that records all transactions across multiple computers, ensuring transparency, security, and immutability.

Crypto market news covers a wide range of topics that revolve around the dynamic and ever-evolving crypto industry. These include price movements and volatility of cryptocurrencies, market trends, regulatory developments, technological advancements, partnerships, security issues, adoption and acceptance by mainstream financial institutions, government policies, and the impact of cryptocurrencies on different sectors.

Market analysis and expert opinions help investors understand the current state of the market and make informed decisions. News articles in this domain often discuss the factors influencing crypto prices such as supply and demand dynamics and market sentiment. Market manipulation, market sentiment analysis tools, trading strategies, and investment advice are also often covered.

Crypto market news also delves into the world of initial coin offerings (ICOs), which are fundraising mechanisms used by startups to sell a portion of their cryptocurrency tokens to early adopters. ICOs have gained significant attention but also faced controversy due to concerns of fraud and lack of regulation.

Various challenges exist within the crypto market realm as well. These include the scalability of blockchains, transaction speed issues, high fees associated with certain cryptocurrencies due to scalability limitations (Bitcoin is a notable example), security vulnerabilities in exchanges or user wallets, hacking incidents targeting exchanges or individual holders of cryptocurrencies – all contributing to an ongoing conversation about ways to improve efficiency, establish regulatory frameworks for increased trust and investor protection.

Moreover, governmental regulations with regards to cryptocurrencies differ worldwide; some countries outright ban cryptocurrencies while others embrace them through favorable regulations. Keeping track of these regulatory developments is crucial for anyone involved in the crypto market.

In conclusion, the crypto market news industry covers critical updates and trends in the exciting world of cryptocurrencies. These include market movements, investment advice, regulatory developments, technological enhancements, and challenges faced by the industry. Keeping abreast of such news is essential for individuals and entities participating actively or passively in the crypto market.

A cryptocurrency, or crypto for short, refers to a digital or virtual form of currency that utilizes cryptography for secure transactions, control the creation of additional units, and verify the transfer of assets. The most well-known example is Bitcoin, which was the first decentralized cryptocurrency introduced in 2009 by an anonymous inventor under the pseudonym Satoshi Nakamoto.

Crypto market news pertains to updates, analysis, trends, and developments within the cryptocurrency market. It encompasses a wide range of subjects related to cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many others. These topics can include price fluctuations, regulatory updates, new applications of blockchain technology, collaborations, partnerships, ICOs (initial coin offerings), expert opinions, and general market conditions.

Investors interested in cryptocurrencies often rely on crypto market news to stay up to date with current events and trends that may impact their investments. It provides insights into market sentiment, potential market-moving factors, and the overall health of the cryptocurrency market. News can come from various sources like reputable financial news platforms, crypto news websites, social media channels, industry conferences, and expert analysis.

The volatile nature of cryptocurrencies makes staying informed about the market crucial for traders and investors. Market news tends to influence price movements and can trigger buying or selling pressure among participants. Events like regulatory actions by governments or central banks, partnerships with significant industries or payment processors, hacking incidents, global economic situations, and pronouncements by influential figures can heavily impact crypto prices.

For this reason, various platforms offer real-time crypto market news aas part of their services. This includes publications like CoinDesk or Coin Telegraph dedicated solely to covering all aspects of the cryptocurrency space. Additionally, mainstream financial magazines often provide insights into major developments occurring within the crypto universe.

Crypto enthusiasts and investors must stay vigilant against fake news as misinformation can have serious consequences. Due diligence is essential when verifying information from various sources and ensuring the credibility and accuracy of the provided news.

In conclusion, crypto market news is an indispensable resource for individuals involved or interested in the cryptocurrency space. It keeps them updated on significant events, market trends, regulatory changes, and investor sentiment, guiding their decision-making processes for trading and investing in digital assets.