Evaluating the Security Features of Popular Mobile Crypto Wallets

Understanding the Importance of Security in Mobile Crypto Wallets

Understanding the Importance of Security in Mobile Crypto Wallets

With the rapidly growing popularity of cryptocurrencies, mobile crypto wallets have become an essential tool for traders and investors to store and manage their digital assets on the go. However, security is a critical aspect that should never be overlooked when utilizing these wallets. To ensure the safety of your funds, it is crucial to comprehend the significance of security features offered by mobile crypto wallets.

Firstly, let’s start with the basics of what a mobile crypto wallet actually is. It functions as a software application designed to securely store, send, and receive cryptocurrencies through mobile devices such as smartphones or tablets. Since cryptocurrencies involve high financial value, the importance of strong security measures cannot be emphasized enough.

One prominent security feature found in most mobile crypto wallets is encryption. Encryption works by converting your sensitive data into an encoded form using complex algorithms. This process provides an additional layer of protection against unauthorized access and ensures the confidentiality of your private keys—a crucial component for accessing your funds securely. Without proper encryption, you remain vulnerable to potential thefts or hacks.

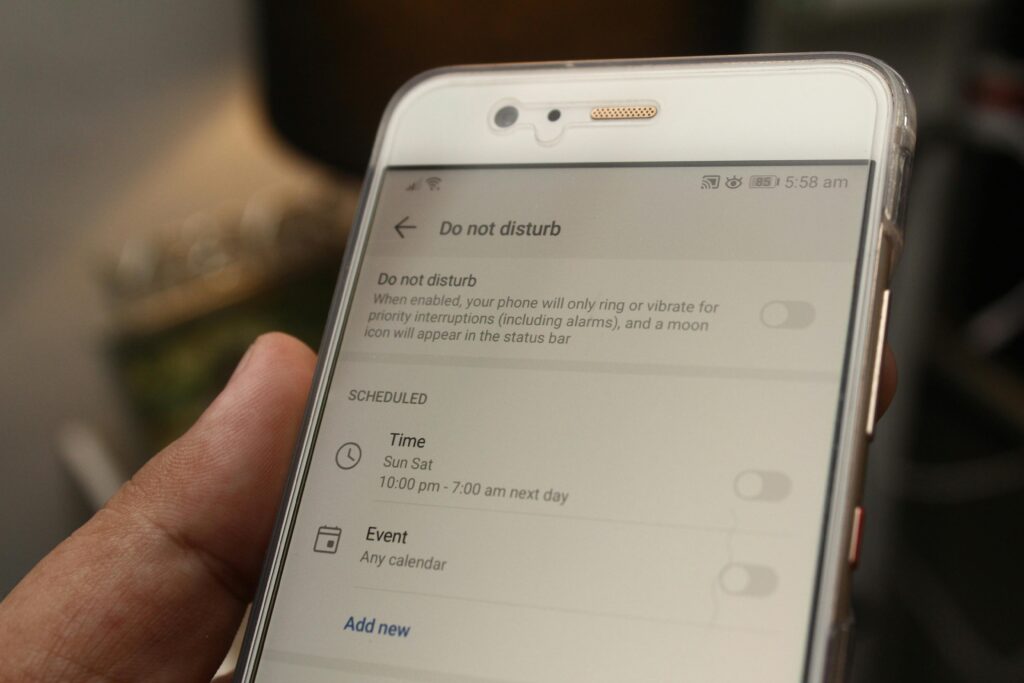

Another crucial aspect regarding security is two-factor authentication (2FA). Enabling 2FA adds an extra layer of protection by requiring not only a password but also a secondary verification method, often through a text message or dedicated authenticator app. By utilizing this feature, even if someone gains unauthorized access to your password, they would still be unable to compromise your mobile crypto wallet without the second means of validation.

Regular updates are vital for maintaining robust security in mobile crypto wallets. Developers frequently release updates to address any known vulnerabilities and bugs that could compromise your wallet’s integrity. Failing to update your wallet regularly may leave you exposed to potential security breaches originating from known vulnerabilities. Stay vigilant and ensure you’re running the latest version of your chosen mobile crypto wallet to maximize its security capabilities.

While selecting a mobile crypto wallet, prioritize wallets backed by strong teams with reputable names in the crypto industry. Accountability and transparency play a significant role, so conduct thorough research to identify the wallet’s development team, reviews, and security record. Opting for open-source wallets is often recommended, as they are subject to constant scrutiny from the wider developer community, increasing the likelihood that any vulnerabilities will be addressed promptly.

In conclusion, the importance of security in mobile crypto wallets cannot be stressed enough. Understanding encryption, utilizing two-factor authentication, staying updated with wallet releases, and selecting wallets with reputable teams are some essential factors to consider. By prioritizing security, you can significantly reduce the risk of falling victim to hacks or other security breaches while enjoying the benefits of a mobile crypto wallet for your digital assets.

A Deep Dive into Encryption Techniques Used by Leading Mobile Crypto Wallets

When it comes to securing crypto assets in mobile crypto wallets, encryption techniques play a critical role in ensuring the integrity and privacy of user transactions. Leading mobile crypto wallet solutions employ advanced encryption methods to safeguard sensitive information and protect digital currencies from unauthorized access. In this deep dive, we will explore some of the common encryption techniques used by these wallets.

- Symmetric Encryption:

Symmetric encryption is a widely utilized method where the same encryption key is used for both encryption and decryption. These wallets generate a unique private key known only to the user, which is used to encrypt their wallet data. This ensures that even if someone gains access to the encrypted information, they cannot decrypt it without the corresponding private key. - Asymmetric Encryption:

Asymmetric encryption, also known as public-key cryptography, utilizes a pair of keys – a public key and a private key. The private key, held only by the user, is used for decryption, while the public key is widely distributed and available to anyone who needs to send encrypted data to the user. Mobile crypto wallets use asymmetric encryption to securely exchange public keys between users when engaging in transactions. This technique ensures that only intended recipients possess the private key required for decrypting transactions. - Hash Functions:

Hash functions are widely employed in mobile crypto wallets to ensure data integrity. The wallet software applies a hash function (e.g., SHA-256) to important data such as transaction details or user credentials. The resulting hash represents a unique fingerprint of the original data. If any changes are made to the data, even minor alterations, the hash value will differ drastically. Wallets use hash functions extensively during verification processes to detect tampering or unauthorized modifications. - Secure Key Storage:

Mobile crypto wallets prioritize secure storage of encryption keys. Hardware security modules (HSMs), which are specialized devices designed for cryptographic tasks, offer an added layer of security by protecting private keys from physical extraction or remote attacks. The keys are stored in an offline environment, often utilizing military-grade encryption, minimizing the risk of compromise. - Multi-factor Authentication:

As an additional security measure, leading mobile crypto wallets often employ multi-factor authentication techniques. These measures go beyond passwords alone and may include methods such as biometric verification (e.g., fingerprint or facial recognition) or hardware tokens. The use of multiple factors enhances the overall security of wallet access and provides additional assurance against unauthorized entry.

Conclusion:

Securing mobile crypto wallets involves a wide array of encryption techniques. Symmetric and asymmetric encryption, along with the use of hash functions, ensure confidentiality, integrity, and non-repudiation of digital assets and transactions. Combined with secure key storage solutions and multi-factor authentication mechanisms, these encryption techniques play a vital role in protecting users’ crypto assets in the ever-evolving world of cryptocurrencies.

Multi-Factor Authentication (MFA) in Mobile Crypto Wallets: A Must-Have Security Feature?

Multi-Factor Authentication (MFA) in Mobile Crypto Wallets: A Must-Have Security Feature?

Mobile crypto wallets have gained immense popularity as they provide users with convenient, on-the-go access to their digital assets. As the crypto market evolves, so do the threats to our digital security. To address these concerns and protect user funds, Multi-Factor Authentication (MFA) has emerged as a crucial security feature for mobile crypto wallets.

MFA is a powerful safeguard that enhances user authentication beyond traditional methods like passwords alone. It requires users to provide at least two different pieces of evidence to verify their identity before accessing their wallet. This usually involves a combination of something a user knows (password), something they possess (for example, a mobile device), or something unique to them (biometric data like fingerprints or facial recognition).

By utilizing MFA in mobile crypto wallets, users benefit from an added layer of protection against attacks such as stolen passwords or unauthorized access. Even if a hacker manages to obtain a user’s password, they still need to authenticate themselves using the second factor, which significantly increases the difficulty of compromising the wallet.

Implementing MFA in mobile crypto wallets is accomplished through various methods. One popular option is through Time-Based One-Time Passwords (TOTP), which generate unique temporary codes normally valid for only 30 seconds. Users install an authenticator app like Google Authenticator and link it to their wallet account. When accessing the wallet, they must enter both their password and the current TOTP generated by the app.

Another widely used method of MFA is push notifications. In this scenario, wallet providers send users a push notification on their linked mobile device whenever they try to log in from an unknown location or device. The user can then approve or deny the login attempt directly from their device, ensuring that only legitimate access is granted.

Biometric authentication, relying on features unique to an individual such as fingerprints or facial recognition, is gaining momentum as an MFA method. With this approach, users must scan their biometric data to access their wallets, providing an additional layer of security as such features are not easily duplicated.

It’s important to note that while MFA can significantly enhance the protection of mobile crypto wallets, it is not a foolproof solution. Potential vulnerabilities still exist, including spoofing attacks or hacking into the device itself. Therefore, users should continue to follow best cybersecurity practices such as regular updates, using strong passwords, and avoiding suspicious links or downloads.

In conclusion, Multi-Factor Authentication (MFA) has become an essential security feature for mobile crypto wallets in light of the evolving digital threats. By combining multiple authentication factors like passwords, biometrics, or possession of a mobile device, MFA provides an extra layer of defense against unauthorized access or compromised passwords. While no security measure is perfect, implementing MFA greatly mitigates risks and safeguards users’ valuable crypto assets in an increasingly interconnected world.

Reviewing the Backup and Recovery Options in Top Mobile Crypto Wallets

Reviewing the Backup and Recovery Options in Top Mobile Crypto Wallets

When it comes to keeping your cryptocurrency safe, mobile crypto wallets play a crucial role. These wallets allow you to securely store your digital assets on your mobile device, giving you access to your funds anytime, anywhere. However, just like any other digital data, losing access to your mobile wallet can be a nightmare. That’s where backup and recovery options come into play.

In the world of crypto, a backup refers to a secure copy of your wallet’s private keys or recovery phrase. These are the essential pieces of information needed to access and recover your funds if something goes wrong with your mobile wallet. Top mobile crypto wallets understand the significance of ensuring their users have convenient and reliable backup options.

One common backup option offered by these wallets is a recovery phrase, sometimes called a “seed phrase” or “mnemonic phrase.” It typically consists of 12 to 24 random, unique words. This recovery phrase acts as a master key that can regenerate all the private keys associated with your wallet. Writing down and storing this recovery phrase offline in a safe place ensures that even if you lose your mobile device or encounter technical issues, you can still recover your wallet and funds.

Some mobile crypto wallets also enable users to create multiple backups, offering extra layers of redundancy and security. This means you can generate more than one recovery phrase or utilize additional methods to backup your private keys. Popular options include backing up on other digital devices or even utilizing hardware wallets – specialized physical devices designed solely for the purpose of securing cryptocurrencies.

It’s important to note that while backup options provide peace of mind, handling them should be done with caution. Exposing your recovery phrase online or sharing it with others compromises the security of your funds. Likewise, storing it digitally without encryption increases the risk of potential hacks and theft.

Another commonly available feature in top mobile crypto wallets is encrypted cloud storage. This option allows you to securely store an encrypted version of your wallet backup on a remote server, often controlled by the wallet provider. While potentially convenient, it’s important to assess whether you trust the cloud provider with your sensitive recovery data.

In conclusion, reviewing the backup and recovery options provided by top mobile crypto wallets should be a fundamental consideration for anyone venturing into the world of cryptocurrencies. Working out an appropriate backup strategy vastly reduces the risk of losing your funds due to unforeseen circumstances. By utilizing recovery phrases, multiple backups and secure storage methods like hardware wallets or encrypted cloud services, you can ensure that your digital assets stay safe and accessible in both smooth and challenging times.

(Note: The information provided here is based on general knowledge and should not be considered financial or investment advice. Always do thorough research and consult professionals before making any cryptocurrency-related decisions.)

The Role of Biometric Security in Enhancing Mobile Crypto Wallet Safety

The Role of Biometric Security in Enhancing Mobile Crypto Wallet Safety

With the increasing popularity and adoption of cryptocurrencies, ensuring the safety and security of mobile crypto wallets has become a crucial concern. Biometric security has emerged as a cutting-edge solution to enhance the level of protection for these digital assets. Through its unique identification capabilities, biometric security offers several advantages that can greatly strengthen the safety of mobile crypto wallets.

One of the primary benefits of biometric security is its ability to ensure reliable user authentication. By using fingerprints, facial recognition, or iris scans, it provides an extra layer of defense against unauthorized access to crypto wallets. Unlike traditional forms of passwords or PINs, which can be vulnerable to theft or guessing, biometrics offer a more secure and easily verifiable method for genuine users.

Biometric security also adds convenience to accessing crypto wallets on mobile devices. With the touch of a finger or a glance at the camera, users can quickly and seamlessly authenticate their identity without the need for cumbersome password entry. This feature not only makes it easier for users but also reduces the likelihood of weak passwords being chosen and used repeatedly.

Furthermore, biometric authentication significantly lowers the risk of identity theft or impersonation. The uniqueness and complexity of biometric signatures make it extremely challenging for hackers to forge or replicate them accurately. Consequently, it deters fraudulent activities such as unauthorized transactions or illegal access to crypto wallets by mitigating the risks associated with stolen passwords or phishing attacks.

Another advantage of biometric security is that it provides constant protection throughout various mobile cryptographic processes. From initiating financial transactions to verifying personal information or making purchases, individuals can rely on the robustness of biometric authentication to safeguard every step along the way.

Moreover, biometrics adopts advanced encryption protocols to secure data transmission between mobile devices and blockchain networks. By integrating cryptographic keys into the biometric process, it ensures that sensitive information remains encrypted and tamper-proof. This protects users’ crypto assets from potential interception or alteration during data transfers.

However, despite the many benefits, biometric-based security is not without its limitations. Biometric data, once compromised, cannot be changed unlike passwords or PINs. Therefore, it is crucial for mobile wallet providers to implement strong encryption techniques and store biometric data securely. Additionally, some individuals may have concerns about privacy infringement with the collection and storage of biometric information, necessitating clear transparency and opt-in policies.

In conclusion, biometric security plays an indispensable role in enhancing mobile crypto wallet safety. Its unique identification methods not only ensure reliable user authentication but also bring convenience and robust protection to various cryptographic processes. By leveraging cutting-edge encryption mechanisms and addressing privacy concerns, biometrics positively contributes to fortifying the security of mobile crypto wallets in the ever-evolving crypto market landscape.

Comparing the Security Features of Hot Wallets vs. Cold Wallets on Mobile Platforms

When it comes to storing cryptocurrencies on mobile platforms, two popular options are hot wallets and cold wallets. Hot wallets are mobile apps that conveniently allow users to access and manage their digital assets directly from their smartphones. On the other hand, cold wallets refer to hardware devices used offline to store crypto securely.

Hot wallets primarily differ from cold wallets in terms of security features. Hot wallets tend to be more vulnerable to hacking and unauthorized access due to their direct connection to the internet. With an active online presence, they are attractive targets for potential digital threats. Cold wallets, however, prioritize security by keeping crypto assets offline, reducing exposure to cyber-attacks significantly.

Hot wallets offer certain security measures to safeguard users’ funds, such as encryption and password protection. To enhance security, some hot wallet providers even provide a seed phrase—a series of words that serves as a backup if the wallet is lost or damaged. However, relying solely on these features might not guarantee absolute protection against sophisticated hackers or malware attacks.

In contrast, cold wallets provide an added layer of security through their disconnected nature. They offer private key storage on hardware devices that make them ideal for long-term storage of large cryptocurrency holdings. By keeping the private keys offline, cold wallets effectively mitigate the risks associated with hacking attempts and the vulnerabilities prevalent in online systems.

Another crucial difference lies in the user experience associated with these two wallet types. Hot wallets generally prioritize ease of use and accessibility, making them popular among traders constantly engaging with cryptocurrencies. Being mobile-based, hot wallets allow seamless transactions and quick access while utilizing well-designed user interfaces for smooth navigation and convenience.

Cold wallets prioritize enhanced security over user friendliness. Although certain cold wallet models now support mobile integration, they often require additional verification steps compared to hot wallets for accessing funds. Unplugging them from the mobile device before making transactions may also seem cumbersome at times. Regardless of such inconveniences, many crypto holders prefer cold wallets due to the paramount importance they place on security.

Choosing the right wallet type ultimately depends on several factors. If constant access to funds and frequent transactions are your top priorities, hot wallets on mobile platforms may be your best bet. However, for users who value maximum security, especially when storing substantial amounts of cryptocurrency for a longer duration, cold wallets present a wiser choice.

It’s worth noting that some opt for a combination of both. They may use a hot wallet for pocket change and daily use while storing large portions of their digital assets in a cold wallet for increased protection. This strategy allows for a balance between accessibility and stringent security measures.

As the crypto industry evolves and new wallet technologies emerge, it becomes essential to stay updated on the ever-evolving security features of hot and cold wallets on mobile platforms. Regularly assessing and comparing these features will enable users to make informed decisions while keeping their cryptocurrencies as secure as possible in an increasingly digitized world.

How Do Popular Mobile Crypto Wallets Protect Against Malware and Phishing Attacks?

Mobile crypto wallets are essential tools for managing and securing cryptocurrencies on the go. As their popularity has surged, so have the potential risks related to malware and phishing attacks. Therefore, developers of popular mobile crypto wallets implement various measures to protect users from such threats.

Popular mobile crypto wallets typically employ a combination of security features and best practices to safeguard user funds. One crucial aspect is implementing strong encryption algorithms to secure private keys stored on the device. By encrypting private keys with high-grade cryptographic ciphers, these wallets ensure that even if the device is compromised, unauthorized access to funds becomes virtually impossible.

To combat malware, crypto wallet applications scan regularly for any signs of malicious software or code. They perform periodic checks on the device’s operating system and other installed apps to identify potential threats or vulnerabilities that could be exploited by attackers. Additionally, security-focused wallets often allow users to verify their downloads using cryptographic hashes, ensuring that the installed application hasn’t been tampered with during the download process.

Moreover, popular mobile crypto wallets frequently enable users to set up additional security measures like multi-factor authentication (MFA) or biometric identification (such as fingerprint or facial recognition) for accessing the wallet application. These extra layers of security reduce the risk of unauthorized access, even if the smartphone itself gets stolen or lost.

Phishing attacks aim to fool users into providing their sensitive information, such as login credentials or private keys, to fraudulent websites or applications resembling legitimate ones. Well-known mobile crypto wallet developers raise awareness among users by sharing information about common phishing techniques and how to recognize them. They often emphasize the importance of manually inputting wallet addresses instead of relying on links received from unknown sources.

To prevent phishing attacks and impersonation scams, mobile crypto wallets employ visual cues and extensive user education. Legitimate wallet applications visually differentiate themselves from fraudulent ones through branding elements like unique logos or visual styles. Prominent wallet developers also engage in active communication through official channels, cautioning users against sharing their sensitive information and offering guidelines to verify the integrity of wallet websites or applications.

Whilst crypto wallets play a vital role in protecting against malware and phishing attacks, users must also prioritize personal cybersecurity. Implementing strong login credentials, keeping wallet software up to date, and regularly reviewing wallet activity can minimize the risk of falling victim to malicious activities.

In summary, popular mobile crypto wallets protect against malware and phishing attacks through encryption of private keys, continuous malware scanning, additional security layers (MFA/biometric authentication), educating users about phishing techniques, visually distinguishing legitimate applications, and actively engaging with users to promote secure practices. Ultimately, these efforts aim to enhance the reliability and trustworthiness of mobile crypto wallets for users entering the exciting world of cryptocurrencies.

The Implementation of Secure Element (SE) Technology in Mobile Crypto Wallets

The implementation of Secure Element (SE) technology in mobile crypto wallets has become a crucial aspect of safeguarding digital assets. Mobile crypto wallets are applications or software that allow users to securely store and manage their cryptocurrencies on their mobile devices.

Secure Element (SE) is a dedicated microchip that provides high-security protection for sensitive data, such as private keys, encryption keys, and other credentials required for accessing and transacting with cryptocurrencies. It is a tamper-resistant hardware component typically embedded within a mobile device’s main processor or separate chip.

SE technology offers multiple layers of security that significantly mitigate the risk of digital asset theft and unauthorized access. Some prominent features facilitated by SE technology in mobile crypto wallets include:

- Hardware-based Security: SE technology brings about a hardware layer of security, making it exceedingly difficult for attackers to compromise the cryptographic keys or extract sensitive information stored on the device. This protection helps prevent potential attacks such as key-loggers or malware targeting mobile operating systems.

- Encryption and Authentication: The SE chip assists in providing secure storage and cryptographic operations, significantly enhancing encryption capabilities and authentication processes. It ensures robust protection for private keys used for signing transactions or decrypting messages, offering an extra layer of safety against hacking attempts.

- Access Control: SE technology enables secure access controls, allowing users to implement additional layers of authentication for accessing their mobile crypto wallets. This can include PIN codes, biometric authentication (fingerprint or facial recognition), or even a combination of various methods. These measures further reinforce security and prevent unauthorized use of the wallet.

- Offline Wallet Operation: With an SE-enabled mobile crypto wallet, users can generate and store private keys offline within the secure element itself during initialization and subsequent usage. This offline generation enhances security by minimizing exposure to potential online attacks commonly associated with internet-enabled devices.

- Integration with Mobile Operating Systems: Crypto wallets leveraging SE technology can integrate seamlessly with the mobile device’s operating system, complementing its built-in security features. This collaborative effort ensures a cohesive security strategy that maximizes protection against various types of threats.

- Increased Trustworthiness: The utilization of SE technology adds an element of trustworthiness, as it undergoes vigorous testing and certification processes before being integrated into mobile devices. This certification assures users that the secure element meets stringent security standards outlined by independent organizations.

However, despite these advantages, it is important to note that no security mechanism is entirely foolproof. Even with SE technology in place, users must remain vigilant and proactive in adopting best practices for overall digital asset security. This includes regularly updating mobile wallets, avoiding suspicious links or phishing attempts, and enabling additional security features provided by the wallet software.

In conclusion, the implementation of Secure Element (SE) technology in mobile crypto wallets provides heightened levels of security by leveraging dedicated hardware-based protection mechanisms. These technology advancements aim to fortify the seclusion of private keys and protect cryptocurrencies from unauthorized access or theft while bolstering user confidence in the increasingly popular market of cryptocurrency transactions.

Anonymity and Privacy Features: Are Mobile Crypto Wallets Keeping Up?

Anonymity and privacy features are crucial when it comes to mobile crypto wallets and their ability to keep up with the dynamic crypto market. In today’s digital landscape, where maintaining anonymity is highly valued, crypto enthusiasts seek secure solutions that prioritize individuals’ privacy concerns.

Mobile crypto wallets play a pivotal role in facilitating crypto transactions on the go. However, maintaining anonymity can be challenging due to the inherently transparent nature of blockchain technology. Typically, all transactions are recorded in a public ledger, allowing anyone to view transaction details. This transparency poses a threat to user privacy as it leaves traces of their financial activities.

To address this concern, several privacy features have been developed for mobile crypto wallets. One commonly utilized technique is encryption, which adds an extra layer of security by encoding the data transmitted between users and their wallets. Encryption ensures that even if an unauthorized entity intercepts the data, it will remain unreadable.

Additionally, many mobile crypto wallets offer users the ability to create multiple addresses, giving them the option to contain transaction histories within separate accounts. This feature provides a degree of anonymity as it separates various financial activities from being linked back to a sole wallet address.

Moreover, mobile crypto wallet developers recognize the importance of offering non-KYC (Know Your Customer) options, catering to those who prioritize anonymity over identity verification. By offering non-KYC wallets or allowing users more control over what personal information is revealed during transactions, these wallets ensure a higher level of privacy.

A significant development in improving privacy features within mobile wallets is notable advancements in technologies like zero-knowledge proofs and ring signatures. These cryptographic techniques tackle transactional privacy concerns while still utilizing blockchain technology. For instance, zero-knowledge proofs enable users to prove ownership or certain facts about their transactions without disclosing unnecessary information. Ring signatures employ a similar principle by mixing different users’ keys to mask transaction origins.

While some commendable advancements have been made in enhancing anonymity and privacy within mobile crypto wallets, challenges persist. Issues around scalability, compatibility, and ease of use still need to be addressed. Furthermore, the need for continuous innovation to counter evolving privacy threats persists.

As the crypto market evolves, mobile crypto wallet developers must remain dedicated to keeping up with privacy expectations. By adopting and integrating cutting-edge techniques and technologies, developers can provide users with privacy features that align with their demands in this ever-changing landscape.

Overall, awareness regarding privacy concerns in the realm of crypto transactions is increasing. Mobile crypto wallets signify the realization of individual user autonomy and control over financial activities. While they have made strides in enhancing anonymity and prioritizing privacy through various techniques, continuous improvement is essential to cater to the dynamic nature of the crypto market and the evolving privacy threats that accompany it.

Regular Updates and Patches: Assessing the Responsiveness of Mobile Crypto Wallet Providers to Security Vulnerabilities

Regular Updates and Patches: Assessing the Responsiveness of Mobile Crypto Wallet Providers to Security Vulnerabilities

Regular updates and patches play a crucial role in maintaining the security and integrity of mobile crypto wallet applications. In a highly dynamic cryptocurrency market, where new threats and vulnerabilities seem to emerge every day, it becomes increasingly important for wallet providers to demonstrate responsiveness in addressing such issues promptly and effectively.

Vulnerabilities in mobile crypto wallets can expose users to significant risks, as it provides an entry point for attackers to compromise sensitive information or steal digital assets. As hackers continuously exploit weak points in software systems, wallet providers must deploy regular updates and patches as a proactive measure against potential threats.

These updates often include security enhancements, bug fixes, performance optimizations, and sometimes even new features. They are designed to address emerging vulnerabilities and address possible security breaches that can result from sophisticated hacking techniques.

Regular updates act as a proactive defense mechanism that keeps up with the ever-evolving threat landscape. By proactively identifying and plugging security holes, wallet providers can protect users from potential exploits and ensure the overall robustness of their platforms.

One critical aspect of assessing the responsiveness of wallet providers is how quickly they release updates when vulnerabilities are identified. Quick response times reflect a dedication to user protection and an emphasis on maintaining a secure ecosystem. Delayed updates may leave users exposed to threats for extended periods, potentially leading to disastrous consequences for their investments.

Effective vulnerability management also involves offering sufficient details about the vulnerabilities addressed in each update. By providing transparent information about the nature of the weaknesses patched, wallet providers empower users with knowledge that enhances their understanding of potential risks.

The frequency of updates is another essential factor to consider when evaluating wallet providers’ responsiveness. With rapid advancements in technology and continuous threats posed by innovative cybercriminals, wallet developers need to stay ahead by rolling out updates regularly.

Furthermore, it is crucial for wallet providers to have efficient mechanisms in place that allow them to promptly alert their user base about significant security vulnerabilities. Proactive communication ensures that users are aware of potential risks and can take necessary precautions to secure their wallets and digital assets.

To conclude, regular updates and patches are vital in the realm of mobile crypto wallets, serving as a crucial line of defense against emerging threats. The responsiveness of wallet providers in addressing security vulnerabilities demonstrates their commitment to user safety and overall platform reliability. Stay informed about updates from your chosen wallet provider to ensure your assets remain protected in the ever-evolving and often turbulent crypto market.

User Experience (UX) and Security: Finding the Balance in Mobile Crypto Wallets

User Experience (UX) and Security are two critical aspects that need to find a delicate balance in mobile crypto wallets. As the popularity of cryptocurrencies continues to grow, more and more people are looking for convenient and secure ways to manage their digital assets on the go.

The User Experience aspect of mobile crypto wallets focuses on providing a seamless and intuitive interface that enables users to easily manage their cryptocurrencies. A well-designed UX ensures that users can navigate through the wallet effortlessly, perform transactions quickly, and access all relevant information with minimum effort. This includes features such as intuitive navigation menus, clear transaction history, real-time market data updates, and customizable settings.

On the other hand, Security plays a vital role in gaining trust and protecting the user’s valuable digital assets. Mobile crypto wallets must prioritize security measures such as encryption, multi-factor authentication, and secure key storage mechanisms to safeguard against potential threats like hacking, phishing, or theft. Protecting passwords or private keys should be a primary focus to prevent unauthorized access that could result in irreversible monetary losses.

Finding the balance between UX and Security is challenging yet crucial. If security measures are too rigidly implemented without considering UX principles, users may find it difficult to navigate the wallet successfully or perform transactions swiftly. This could lead to frustration and deter users from fully utilizing the wallet’s potential.

Alternatively, heavily prioritizing UX without compromising on security might create vulnerabilities that can be exploited by malicious actors. Thus, a mobile crypto wallet must ensure a balance between these two aspects by implementing robust security measures while maintaining an intuitive interface that allows users to intuitively interact with their funds.

One approach to striking this balance is conducting thorough usability testing during the development process. This involves gathering feedback from potential wallet users regarding their experience navigating through different functions. By incorporating user feedback early on in the design process, developers can streamline workflows and identify potential security pitfalls without hampering user experience.

Additionally, creating comprehensive educational resources within the wallet itself can address user security concerns. Tutorials, explanations of security measures, and tips to identify phishing attacks will empower users, making them aware of potential risks while allowing for a more secure interaction with their wallet.

Ultimately, mobile crypto wallets must appreciate the importance of User Experience and Security, viewing both as equally crucial ingredients for success. Striking the right balance ensures that users can entrust their digital assets within the wallet while enjoying a smooth, accessible, and user-friendly experience.

Understanding Decentralized Finance (DeFi) Integration and Its Impact on Mobile Wallet Security

Understanding Decentralized Finance (DeFi) Integration and Its Impact on Mobile Wallet Security

Decentralized Finance (DeFi) has emerged as a revolutionary concept in the crypto market, enabling individuals to participate in various financial activities without the need for intermediaries like banks. This disruptive trend is transforming the traditional financial landscape by leveraging decentralized technologies such as blockchain. As DeFi gains traction, it becomes essential to grasp how integration with mobile wallets affects user security.

The significance of DeFi integration lies in its ability to offer finance-related services like lending, borrowing, yield farming, and asset swapping directly within the decentralized ecosystem. Unlike traditional financial platforms, DeFi applications offer transparency, improved liquidity, privacy, and control over one’s funds. The integration of DeFi capabilities into mobile wallets brings these advantages to users’ fingertips, making financial activities more accessible than ever.

However, this convenience and accessibility present various security challenges which users must understand. Mobile wallets act as digital wallets compatible with smartphones, allowing users to store cryptocurrencies and engage with decentralized apps (dApps) seamlessly. As DeFi is integrated into these wallets, it expands the spectrum of possible attacks nullifying some common security practices.

The biggest concern in DeFi integration within mobile wallets lies in potential vulnerabilities arising from malware attacks or phishing attempts. Mobile wallets are increasingly targeted by hackers seeking ways to compromise user security and gain unauthorized access to their funds. Since DeFi transactions involve sensitive private keys and substantial amounts of cryptocurrency, they often become prime targets for cybercriminals.

Another aspect to consider is the vast ecosystem of both established and upcoming DeFi protocols and dApps. Their integration into mobile wallets significantly amplifies the complexity of managing security risks. Mobile wallet developers must carefully vet third-party integrations to ensure that users are not exposed to malicious codes or unauthorized transfers. Proper auditing mechanisms should be implemented to add an additional layer of protection against complex vulnerabilities.

Furthermore, user awareness is critical when it comes to mobile wallet security in the context of DeFi integration. Users should exercise caution when engaging with DeFi protocols through their wallets, ensuring they understand the risks properly. This includes recognizing potential scam projects, understanding the nature of smart contracts, and practicing good internet hygiene to avoid falling victim to phishing attacks.

To mitigate security risks posed by DeFi integration, mobile wallets should prioritize multi-factor authentication and biometric features like fingerprint or facial recognition. Advanced encryption techniques and hardware-based security layers can offer stronger protection against potential breaches. Additionally, integrating AI-powered anomaly detection systems can help identify suspicious patterns in real-time, alerting users to possible threats.

Given the objective of DeFi’s democratization of finance, it is vital that mobile wallet developers take the lead in implementing robust security measures. Regular software updates, bug bounty programs, and community collaboration can contribute significantly to addressing vulnerabilities promptly and maintaining user trust.

In conclusion, the integration of DeFi capabilities within mobile wallets empowers individuals to engage in decentralized financial activities with ease. However, this convenience necessitates heightened attention towards mobile wallet security. Users must stay vigilant and take necessary precautions while mobile wallet developers need to enhance security measures extensively. Ultimately, a collaborative effort between users and developers can promote a safe and secure DeFi experience through mobile devices.

The Future of Security in Mobile Crypto Wallets: Emerging Technologies and Threats

The Future of Security in Mobile Crypto Wallets: Emerging Technologies and Threats

With the rise of cryptocurrencies, mobile crypto wallets have become a popular means of storing and managing digital assets on-the-go. However, as the crypto market continues to expand, so do the security concerns surrounding these mobile wallets. To address these issues and ensure a safe future for crypto users, emerging technologies are being developed while adversaries also employ new threats in this evolving ecosystem.

One of the key emerging technologies that promise enhanced security in mobile crypto wallets is biometric authentication. Unlike traditional password-based authentication methods, biometrics offer a more secure way to protect personal funds. Utilizing strong passwords or PINs can be easily exploited through hacking or phishing attacks. Biometric data such as fingerprints or facial recognition can provide an extra layer of authentication, making it difficult for unauthorized parties to gain access to crypto assets.

Another technology swiftly gaining traction is multi-factor authentication (MFA). MFA involves combining two or more independent authentication factors, such as a fingerprint scan or facial recognition paired with a one-time password or hardware token. By requiring multiple types of verification, MFA ensures that even if one authentication factor is compromised, attackers are still unable to access the wallet.

In response to emerging technologies, adversaries have also adapted their strategies to target mobile crypto wallets. One prominent threat is malware specifically designed to target crypto-related apps and steal user credentials or cryptographic keys. This malware could silently infect a device and gain access to sensitive information without the user’s knowledge. Vigilance against downloading apps from unauthorized sources is crucial in mitigating this risk.

Phishing attacks are also a prevailing threat in the mobile crypto wallet space. Attackers impersonate trustworthy entities through deceptive emails, text messages, or websites with the intention of tricking individuals into revealing sensitive information. These attacks can lead to substantial financial losses and compromise the security of mobile wallets. Implementing educational awareness campaigns to inform users about safe online practices is paramount to counter this type of cyber threat.

As cryptocurrencies continue to expand and evolve, it’s evident that the security landscape surrounding mobile crypto wallets will also continue to advance. Blockchain technology, the backbone of most cryptocurrencies, inherently offers security benefits by providing decentralized and tamper-proof transaction records. Additionally, Hardware Security Modules (HSMs) are being integrated into mobile devices, offering a safe storage environment for cryptographic keys.

Despite these developments, there will always be vulnerabilities to exploit and new threats to combat. The challenge lies in staying proactive by consistently updating security protocols, employing emerging technologies, and educating individuals within the crypto ecosystem. Only through a combination of robust technology and increased awareness can the future of security in mobile crypto wallets be safeguarded against emerging threats.

Smart Contract Safety Measures in Mobile Crypto Wallets: Evaluating Risks and Protections

Smart contracts have revolutionized the way transactions are executed within the crypto market by ensuring automation, transparency, and security. However, using smart contracts in mobile crypto wallets comes with its own set of risks that need to be addressed to ensure user protection.

When evaluating smart contract safety measures in mobile crypto wallets, it is crucial to consider potential risks and deploy adequate protections. One significant concern lies in possible vulnerabilities within the smart contracts themselves. These vulnerabilities could be exploited by malicious actors to manipulate transactions, steal funds, or cause unauthorized actions. Solidity-based security analysis tools can help identify such flaws before releasing smart contracts on the blockchain.

Another key consideration is securing private keys and cryptographic assets within a mobile wallet. Since smart contracts are typically executed through digital signatures, hackers gaining access to a user’s private keys could potentially exploit this and tamper with the underlying contract code. Mobile crypto wallet providers must implement stringent security protocols to safeguard private keys. This may include multiple authentications, encryption techniques, biometric locks, or utilizing hardware wallets for added protection.

In addition, it is vital to evaluate the reliability and trustworthiness of third-party service providers associated with mobile crypto wallets. Regular audits of their integration processes and security measures can help minimize potential vulnerabilities caused by weak links. Additionally, promoting open-source development practices aids scrutiny of code quality and allows security experts to identify any hidden flaws.

The use of multi-signature functionality in smart contracts enhances wallet security by requiring multiple parties to authenticate transactions before they can be executed. Distributing transaction validation across different entities reduces the risk of single points of failure or unauthorized access.

Furthermore, staying informed about emerging security threats prevalent in the crypto ecosystem is crucial for promoting a safe environment for users. Continuously monitoring vulnerability databases and seeking advisories from cybersecurity professionals would enable mobile wallet developers and users to stay updated on potential risks, allowing them to respond promptly.

Continuous testing using simulated attacks or analyzing past exploit cases can uncover potential vulnerabilities in smart contract codes or mobile wallets themselves. Such testing allows developers to patch security flaws and enhance the overall reliability of their systems.

Implementing comprehensive backup solutions can protect against potential loss of funds due to device loss, damage, or cyberattacks. Users are encouraged to regularly backup their wallets and store their recovery phrases securely to prevent catastrophic losses.

Smart contract safety measures in mobile crypto wallets need to be diligently evaluated and implemented to safeguard users’ digital assets. It requires a combination of technological solutions such as secure smart contract coding, tamper-resistant private key storage, reputable third-party integrations, multi-signature functionality, active threat monitoring, rigorous testing, and proactive backups. Adopting these practices will help ensure a safer ecosystem for anyone engaging in crypto transactions through mobile wallets.