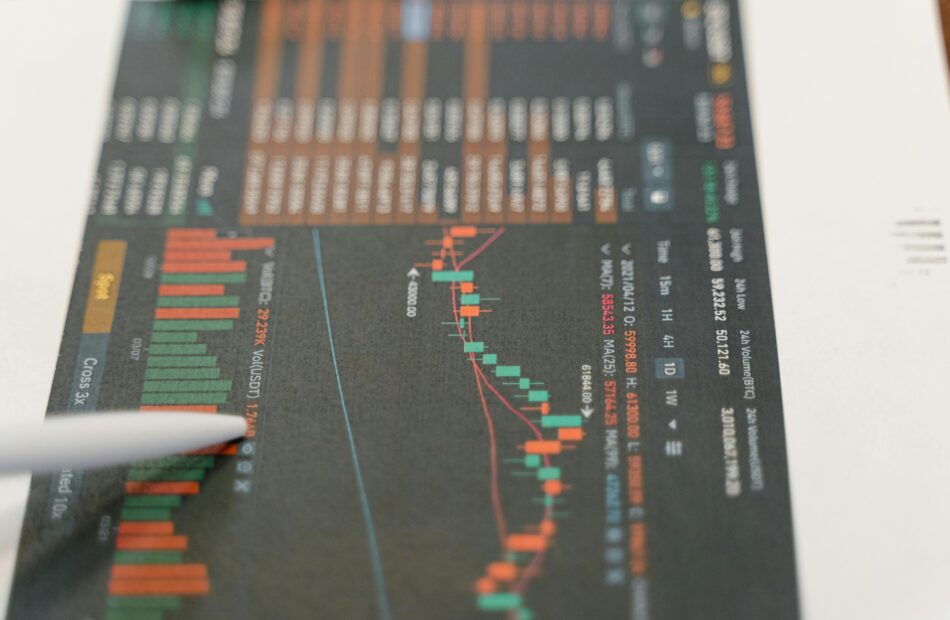

Scalping vs. Swing Trading

Scalping is a short-term trading strategy that aims to make quick profits from small price fluctuations, while swing trading is a medium-term strategy that seeks to capture larger price movements over several days or weeks.

Forks in the Road: Understanding How Network Splits Affect Miners and Market Dynamics

Forks in the Road is a study that examines the impact of network splits on miners and market dynamics by analyzing cryptocurrency fork events

The Role of Renewable Energy Sources in Reducing Crypto Mining’s Carbon Footprint

The role of renewable energy sources in reducing crypto mining’s carbon footprint is to eliminate the reliance on fossil fuels and promote clean energy generation for powering mining operations

Location, Location, Location: How Geography Affects Crypto Mining Efficacy and Costs

“Location, Location, Location: How Geography Affects Crypto Mining Efficacy and Costs explores how the geographical location of mining operations impacts their effectiveness and expenses in the world of cryptocurrency.”

Balancing Risk and Reward: The Economics of Investing in Crypto Mining

Balancing Risk and Reward: The Economics of Investing in Crypto Mining is a study that explores how potential gains and challenges determine the feasibility of investing in cryptocurrency mining

Exploring the Newest Trends in Crypto Mining Software Solutions

Exploring the Newest Trends in Crypto Mining Software Solutions involves examining the latest advancements and innovative features in technologies that optimize mining processes, improve efficiency, enhance security protocols, and accommodate different types of cryptocurrencies

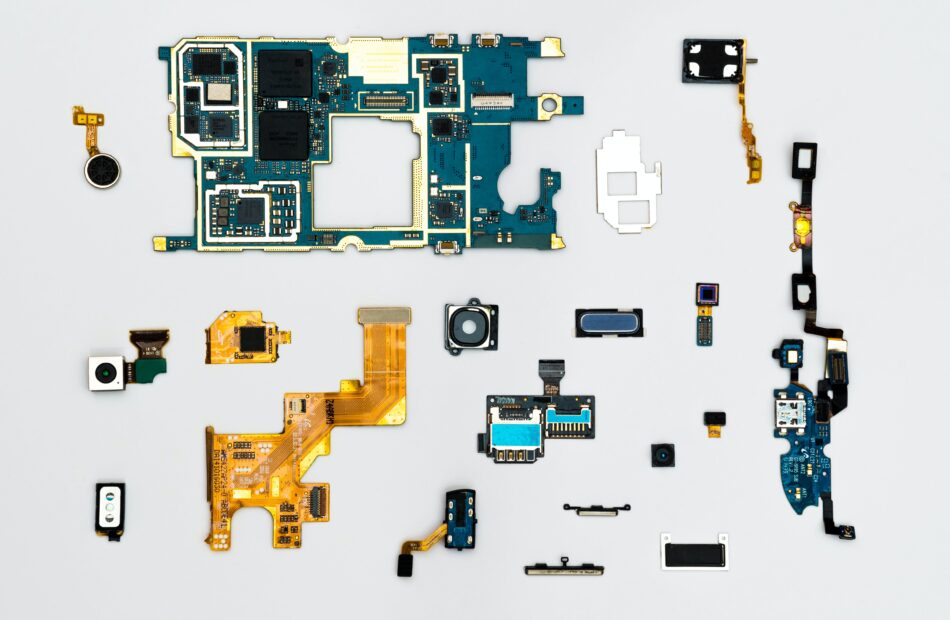

ASIC vs. GPU vs. CPU: Choosing Your Path in Crypto Mining Hardware

ASIC vs. GPU vs. CPU: Choosing Your Path in Crypto Mining Hardware is a comparison of different types of hardware used for cryptocurrency mining, with ASICs being specialized processors, GPUs being graphics cards, and CPUs being general-purpose processors

Deciphering the Impact of Halving Events on Bitcoin Mining and Market Value

Deciphering the impact of halving events on bitcoin mining and market value involves examining their effect on scarcity, miners’ rewards, and the subsequent potential shift in supply-demand dynamics resulting in fluctuations in the market value of bitcoin

Environmental Concerns and Sustainable Practices in Crypto Mining

Environmental Concerns and Sustainable Practices in Crypto Mining refers to the awareness and implementation of measures aimed at mitigating the negative impact of mining cryptocurrencies on the environment, while promoting sustainable practices for a more eco-friendly industry

Efficiency in Crypto Mining: The Evolution of Hardware Technologies

Efficiency in crypto mining refers to the improvement and progression of hardware technologies that maximize computational power while minimizing energy consumption, resulting in faster and more cost-effective mining processes

Breaking Down the Process of Setting Up a Home Crypto Mining Rig

Breaking down the process of setting up a home crypto mining rig involves selecting compatible hardware, assembling the rig, installing mining software, configuring settings, connecting to a mining pool, and occasionally troubleshooting any issues that may arise

Navigating the Legal Landscape of Crypto Mining Across the Globe

Navigating the Legal Landscape of Crypto Mining Across the Globe explores the legal frameworks and regulations surrounding cryptocurrency mining activities at an international level

Masters of the Field: A Look at Leading Crypto Mining Companies

Masters of the Field: A Look at Leading Crypto Mining Companies is a comprehensive examination of the top players in the cryptocurrency mining industry, analyzing their operations, technologies, and impact on the broader crypto landscape

The Economic Implications of Crypto Mining on Global Energy Consumption

The economic implications of crypto mining on global energy consumption involve the increasing demand for electricity and potential strain on resources and infrastructure, leading to environmental concerns and potential economic disparities

How Proof of Work and Proof of Stake Differ in Crypto Mining

Proof of work consensus mechanism involves miners solving complex mathematical problems to validate transactions and secure the blockchain, while proof of stake relies on validators with majority stakes in the cryptocurrency to create new blocks and validate transactions

Understanding Crypto Mining: The Backbone of Cryptocurrency

Understanding crypto mining is crucial as it forms the fundamental infrastructure of cryptocurrency by validating and adding transactions to the blockchain while creating new digital coins

Ledger’s Latest Security Upgrade: What You Need to Know

Ledger’s latest security upgrade introduces a new firmware version that enhances the overall security of their cryptocurrency wallets, specifically targeting flaws related to Bluetooth connectivity

A Deep Dive into the Security Protocols of Leading Crypto Exchanges and Their Wallets

This document explores the security measures implemented by the top cryptocurrency exchanges and their wallets

How Decentralized Finance (DeFi) Impacts Crypto Wallet Security

Decentralized Finance (DeFi) impacts crypto wallet security by introducing new vulnerabilities and risks, such as smart contract bugs, protocol failures, and increased reliance on users managing their own private keys

Cryptocurrency and Insurance: Protecting Your Digital Assets

Cryptocurrency and Insurance: Protecting Your Digital Assets is the safeguarding of digital currencies and related assets through insurance products that offer financial protection against theft, loss, or damage

Evaluating the Security Features of Popular Mobile Crypto Wallets

Evaluating the Security Features of Popular Mobile Crypto Wallets involves assessing their protective measures against potential breaches and vulnerabilities in order to ensure the users’ digital assets are safely stored and transactions are secure

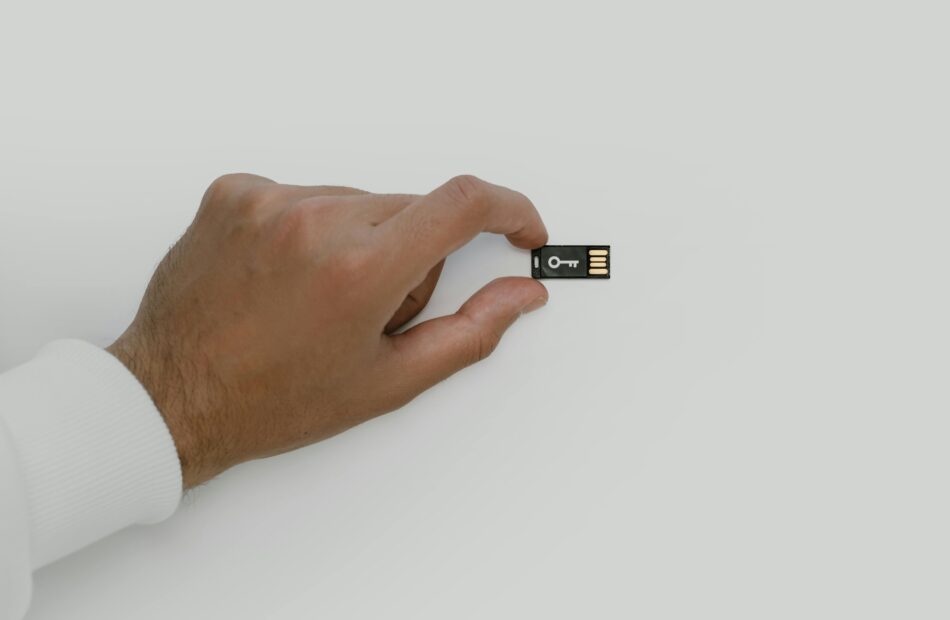

Best Practices for Keeping Your Private Keys Safe

Some best practices for keeping your private keys safe include using strong and unique passwords, storing the keys in encrypted databases or hardware wallets, and regularly updating and patching your software to prevent any vulnerabilities

Multi-Signature Wallets: Increasing Security for Crypto Assets

Multi-Signature Wallets are a security measure for cryptocurrency assets that require multiple authorized parties to sign off on transactions, enhancing the overall security and reducing the risk of fraud

Smart Contract Vulnerabilities and Wallet Security

Smart Contract Vulnerabilities refer to potential flaws or weaknesses in the code of a smart contract that can be exploited, while Wallet Security refers to the protection and safeguarding measures implemented to secure digital wallets holding cryptocurrencies or other digital assets

Hardware Wallets: Are They Worth the Investment?

Hardware wallets are secure devices designed to store cryptocurrency offline and away from potential cyber threats, making them a valuable investment for those seeking maximum security for their digital assets

The Importance of Regular Crypto Wallet Backups

The Importance of Regular Crypto Wallet Backups is to protect and secure your digital assets, safeguard against potential data loss or device failure, and ensure the ability to restore and access your funds in case of any unforeseen circumstances

A Guide to Safely Storing Your Cryptocurrency

A Guide to Safely Storing Your Cryptocurrency provides essential information and best practices for securely managing and safeguarding your digital assets

Phishing Scams to Avoid in the Crypto World

Phishing scams to avoid in the crypto world are fraudulent attempts to steal sensitive information or cryptocurrency holdings by impersonating reputable individuals, organizations, or platforms through deceptive emails, websites, or social engineering techniques

The Most Secure Crypto Wallets Available in 2023

The most secure crypto wallets available in 2023 are a combination of hardware wallets and custodial wallets provided by reputable companies that prioritize strong encryption, multi-factor authentication, and cold storage mechanisms to protect user funds

How to Set Up Two-Factor Authentication for Your Crypto Wallet

“Learn how to add an extra layer of security by setting up two-factor authentication for your cryptocurrency wallet.”

Understanding the Different Types of Crypto Wallets: Hot vs. Cold Storage

Understanding the Different Types of Crypto Wallets: Hot vs. Cold Storage offers insights into the two main categories of cryptocurrency wallets, explaining their features, benefits, and security measures

Ethical Hacking and Security Testing in Enhancing the Safety of Cryptocurrency Exchanges

Ethical hacking and security testing enhance the safety of cryptocurrency exchanges by identifying vulnerabilities and potential threats, thereby helping to prevent hacks and safeguard user funds

Navigating the Risks: How to Avoid Scams and Frauds on Cryptocurrency Exchanges

“Navigating the Risks: How to Avoid Scams and Frauds on Cryptocurrency Exchanges” is a guide that provides essential tips and strategies to safeguard oneself from scams and fraudulent activities when dealing with cryptocurrencies

The Benefits of Peer-to-Peer (P2P) Cryptocurrency Exchanges over Traditional Platforms

The benefits of Peer-to-Peer (P2P) cryptocurrency exchanges over traditional platforms include increased privacy, reduced reliance on intermediaries, and a potentially wider selection of cryptocurrencies available for trading

API Integration for Automated Trading on Cryptocurrency Exchanges: A Beginner’s Guide

API integration for automated trading on cryptocurrency exchanges refers to the process of connecting and utilizing Application Programming Interfaces to enable programmatic and algorithmic trading on these platforms

The Process of Listing New Coins on Cryptocurrency Exchanges: An Inside Look

“The process of listing new coins on cryptocurrency exchanges involves thorough evaluations of the project’s legitimacy, market demand, technology, legal compliance, and potential risks to ensure a reliable and profitable addition to the exchange’s offerings.”

Innovative Features and Trends Shaping the Future of Cryptocurrency Exchanges

Innovative features and emerging trends are transforming cryptocurrency exchanges, enabling increased security, scalability, decentralized finance (DeFi) integration, and user-friendly interfaces to shape the future of this evolving industry

How to Safely Store Your Digital Assets Outside of Cryptocurrency Exchanges

“How to Safely Store Your Digital Assets Outside of Cryptocurrency Exchanges provides guidance on secure methods to protect and preserve digital assets such as cryptocurrencies.”

Cryptocurrency Exchange Regulations Around the World: A Comprehensive Guide

Cryptocurrency Exchange Regulations Around the World: A Comprehensive Guide is a detailed overview of the various regulatory frameworks pertaining to cryptocurrency exchanges in different countries worldwide

Exploring the Role of Stablecoins in Cryptocurrency Exchanges

“Exploring the Role of Stablecoins in Cryptocurrency Exchanges” investigates the potential impact and utility of stablecoins as a means of introducing stability and reducing volatility in cryptocurrency trading platforms

The Impact of Hacking Incidents on Cryptocurrency Exchanges and Market Confidence

The impact of hacking incidents on cryptocurrency exchanges and market confidence can result in significant financial losses for investors, erosion of trust in the security of digital assets, and a decline in overall market activity

KYC and AML Compliance in Cryptocurrency Exchanges: What It Means for Users

KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance in cryptocurrency exchanges are regulatory measures aimed at verifying the identities of users and preventing illegal activities such as money laundering, terrorism financing, and other illicit actions within the cryptocurrency space

The Rise of Decentralized Finance (DeFi) Exchanges: Future of Trading?

The Rise of Decentralized Finance (DeFi) Exchanges: Future of Trading explores the emergence and potential of decentralized finance exchanges as a transformative force in the trading industry

How to Choose a Cryptocurrency Exchange: A Guide for Beginners

How to Choose a Cryptocurrency Exchange: A Guide for Beginners provides comprehensive information and essential tips on selecting the most suitable cryptocurrency exchange platform

Decentralized vs. Centralized Cryptocurrency Exchanges: What Investors Need to Know

Decentralized vs. centralized cryptocurrency exchanges refer to the distinction between trading platforms that operate on a distributed network with no central authority and those that are controlled by a single entity, resulting in differences in security, privacy, and management

Understanding the Importance of Liquidity in Cryptocurrency Exchanges

Understanding the importance of liquidity in cryptocurrency exchanges is crucial as it ensures efficient trading, price stability, and enhanced investor confidence

Overview of the Top Cryptocurrency Exchanges: Fees, Security, and Features Comparison

The overview provides a comprehensive analysis and comparison of the top cryptocurrency exchanges, highlighting key factors such as fees, security, and features they offer to assist users in making informed decisions

Decentralized Identity: Empowering Users with Self-Sovereign Identities through Blockchain

Decentralized Identity is a system that grants individuals control over their own digital identities by utilizing blockchain technology, giving them the ability to hold and manage their personal information securely

Tokenization of Assets: A Game Changer for Investment and Ownership Models

Tokenization of assets refers to the representation of physical assets, such as real estate or artwork, as digital tokens on a blockchain platform, revolutionizing investment and ownership models by increasing liquidity, accessibility, and fractional ownership opportunities

Central Bank Digital Currencies (CBDCs): A New Frontier for National Economies

Central Bank Digital Currencies (CBDCs) refer to the introduction of digital forms of a nation’s currency by its central bank, potentially empowering countries with new economic opportunities and financial technology advancements